The thriving GLP-1 market has revolved around weekly injections. By 2026, new obesity medications will advance the sector into a new era.

Patients are beginning to access the first GLP-1 pill for obesity developed by the Danish firm Novo Nordisk — a daily medication that shares its brand name with the well-known injection Wegovy. A GLP-1 drug from its main competitor Eli Lilly is not far behind, with a U.S. approval anticipated in the coming months.

For some individuals, pills may present a more convenient — and potentially less expensive — option compared to current blockbuster injections. The cash costs for Novo Nordisk’s Wegovy pill range from $149 to $299 per month, based on the dosage, which is marginally lower than the recently reduced cash prices of injections.

While the pills are not projected to lead to greater weight loss than weekly injections, based on different clinical trials, some health professionals suggest that broadening the treatment options could still be a significant benefit for patients.

Pills might draw new patients seeking obesity treatment for the first time, enlarging the larger weight loss and diabetes medication market and possibly enhancing sales for Novo Nordisk and Eli Lilly. New users may encompass those who are apprehensive about needles, as well as patients who could gain from existing injections but don’t consider their situation serious enough to require a weekly injection.

“I think a lot of people out there haven’t attempted these GLP-1 drugs and might be waiting for the pills to launch,” stated Dr. Eduardo Grunvald, medical director of the UC San Diego Health Center for Advanced Weight Management. “It’s a natural inclination for some individuals and even some prescribing practitioners.”

“Furthermore, if one has to cover the expenses out of their own pocket, the pills will be slightly cheaper than the injections, which serves as another incentive,” he added.

The exact number of people currently utilizing GLP-1 medications in the U.S., particularly for obesity, remains uncertain. However, about 1 in 8 adults reported using a GLP-1 drug for weight loss or to manage another chronic ailment as of November, according to a survey conducted by health policy research organization KFF.

Now, pills are emerging as the next frontier for Novo Nordisk and Eli Lilly, who have pioneered the GLP-1 market that some analysts project could be valued at nearly $100 billion by the 2030s. In August, Goldman Sachs analysts estimated that pills could secure approximately 24% — or roughly $22 billion — of the global weight-loss drug sector by 2030.

Here’s a look at how obesity pills could transform the landscape.

Pills could broaden the market

Oral medications may draw new patients into the obesity treatment arena.

“I believe this will significantly broaden the market,” Novo Nordisk CEO Mike Doustdar remarked to CNBC in late December. “From our own family and social circles, we recognize that many individuals still prefer not to take an injection … for this demographic, having a pill alternative is crucial.”

Pills could encourage some individuals to initiate obesity treatment because “they perceive it as more acceptable or accessible” compared to an injection, commented Dr. Caroline Apovian, co-director of the Center for Weight Management and Wellness at Brigham and Women’s Hospital.

However, this does not imply that a pill will suit everyone. Yet, once patients engage with the health-care system for treatment, doctors can guide them through the various options — whether that entails an injection, metabolic surgery, or structured dietary and exercise plans, Apovian stated.

Grunvald from UCSD indicated that the adoption of obesity pills is likely to be driven by primary care physicians, who manage the majority of eligible patients and may feel more at ease prescribing an oral medication.

He noted that obesity medicine specialists, who care for only about 5% to 10% of those eligible, are more inclined to continue favoring injections, which appear to deliver better results than pills according to separate clinical trials.

Deborah, a 53-year-old librarian from St. Louis, Missouri, expressed her curiosity about the new Wegovy pill, partly due to its convenience. She opted not to share her last name due to concerns about the stigma surrounding GLP-1s.

Deborah stated she would contemplate an oral GLP-1 since she is already accustomed to taking pills for other medications. She mentioned that an oral treatment would provide added advantages, such as simplifying travel plans as it does not require refrigeration like injections do.

She also expressed interest in the potential cost savings with pills. Deborah has been on weekly Wegovy injections since June and was paying $449 per month in cash before Novo Nordisk reduced that price to $349 per month.

Pills are slightly less expensive

Cost could influence other patients as well.

Novo Nordisk’s pill seems to have some of the lowest cash prices available, at $149 per month for the initial dose and $299 per month for the two highest doses. Eli Lilly’s competing pill is expected to have comparable pricing for cash-paying customers.

Such users will also be able to access the starting dose of both pills for $149 per month through President Donald Trump‘s direct-to-consumer platform, TrumpRx, under an agreement both firms reached with his administration in November.

Accessing obesity injections has historically been challenging for patients due to inconsistent insurance coverage and list prices near $1,000 per month. Both Novo Nordisk and Eli Lilly have worked to alleviate these issues by cutting cash prices for their injectable medications to less than half that amount.

Eli Lilly announced in December that the highest doses of single-dose vials of Zepbound will retail for $449 per month for cash-paying clients, while Novo Nordisk indicated in November that almost all doses of Wegovy will be priced at $349 per month in cash.

These prices align more closely with the cost of Novo Nordisk’s pill, which may still be steep for some. However, Grunvald noted that the approximately $150 monthly difference between the highest doses of Zepbound and Novo’s pill “could represent a significant distinction for many individuals” willing to pay out of pocket.

Patients covered by insurance for Novo Nordisk’s oral drug might pay as little as $25 per month for the treatment. Nevertheless, pills are unlikely to significantly enhance insurance coverage for GLP-1s addressing obesity in the U.S.

The direct-to-consumer cash pricing for Novo Nordisk’s oral medication is likely “considerably less” than what employers and intermediaries like pharmacy benefit managers would be charged to provide the drugs, stated John Crable, senior vice president of Corporate Synergies, an insurance and employee benefits consultancy.

Crable remarked that the final cost of the pill to payers like employers remains ambiguous, as those prices aren’t made public. However, if they reflect injection costs — often exceeding $1,000 monthly — employers may hesitate to include the drug in their formularies, he noted.

Some companies that currently provide coverage for obesity injections might add the pills this year. Nonetheless, Crable mentioned that some employers have actually discontinued coverage for GLP-1s aimed at obesity in 2026 due to their high expenses.

“I anticipate employers won’t be particularly eager to incorporate what is likely going to be another high-volume, very costly medication into their formulary when the direct-to-consumer pricing is significantly cheaper,” Crable stated.

Injections are here to stay

Pharmaceutical firms have attempted to assert that transitioning patients using injections to oral medications can be done smoothly. In December, Eli Lilly released findings indicating that patients who initially utilized Wegovy or Zepbound injections maintained most of their weight loss after transitioning to the company’s pill.

However, Apovian from Brigham and Women’s Hospital remarked that the only substantial reason to migrate patients, who are currently doing well with injections, to a pill would be cost.

“If the [cash price] is similar, I generally favor the injectables because I believe the weight loss is superior, and the side effects are diminished,” she stated.

Apovian expressed her desire to see real-world data comparing the efficacy of pills with injections, but varied late-stage trials have already provided some insights.

Zepbound has demonstrated average weight loss exceeding 20% in late-stage analyses, outpacing results from both the Wegovy injection and pill, as well as Eli Lilly’s oral medication in separate studies.

In those same trials, under 7% of patients discontinued treatment due to side effects from the Zepbound and Wegovy injections.

The Wegovy pill exhibited a comparable discontinuation rate, while approximately 10.3% of patients taking the highest dose of Eli Lilly’s oral drug ceased treatment because of side effects.

Leerink Partners analyst David Risinger indicated that patients with obesity requiring substantial weight loss will likely prefer injections, unless they possess a fear of needles.

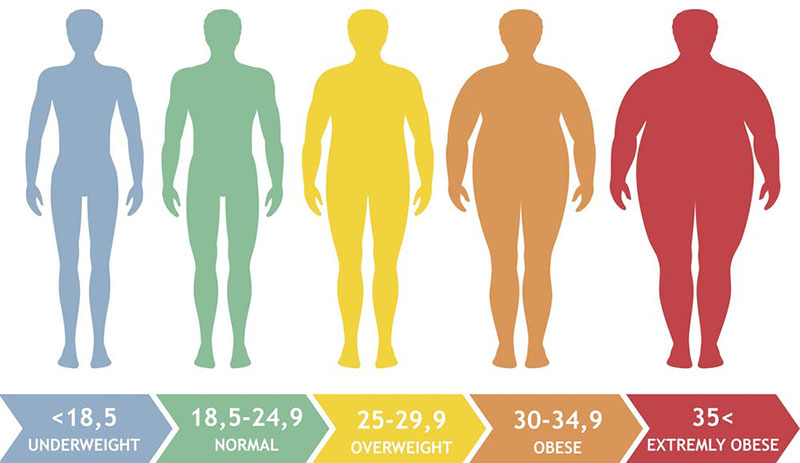

Pills could primarily attract newly diagnosed patients who are just overweight or mildly obese and seek only to achieve “modest” weight loss, he noted.

Some patients currently on weekly injections may explore pills, Risinger added, but not all will find a daily oral treatment more convenient.

This includes Karen Galante, 42, from Horsham, Pennsylvania, who is currently on a compounded version of semaglutide — the active ingredient in Wegovy — which she believes costs similarly to Novo Nordisk’s new pill.

Galante indicated she does not intend to switch.

“It’s challenging enough for me to remember to take my vitamins daily,” she commented. “I appreciate the set-it-and-forget-it aspect of administering one shot a week.”

A sufficient market for Novo, Lilly

Risinger expressed his anticipation that both pills from Novo Nordisk and Eli Lilly will “take off rapidly” this year.

He noted greater initial uptake for the Wegovy pill, given that Eli Lilly’s drug, orforglipron, is likely still months from hitting the market.

However, Risinger believes Eli Lilly’s pill will ultimately yield higher sales because patients might find it more convenient.

Eli Lilly’s orforglipron is a small-molecule medication that is absorbed more efficiently by the body and does not necessitate dietary constraints like Novo Nordisk’s pill, which is a peptide drug. Patients are required to consume no more than four ounces of water with the Wegovy pill and must wait 30 minutes before consuming anything else each day.

Nonetheless, Novo Nordisk’s CEO Doustdar has contended that these dietary requirements will not obstruct adoption. He mentioned in December that this has not posed an issue for over a million individuals taking the lower-dose version of the pill for diabetes, marketed as Rybelsus, which was introduced in 2019.

“Simply sip and proceed, and you’ll be fine,” Doustdar stated. “These individuals wake up in the morning, take their pill with a glass of water, and continue their day-to-day activities half an hour later and carry on with their lives.”

He also referred to the product as the “most effective pill,” asserting that no other products in development have demonstrated the same level of weight loss in a late-stage trial.

The highest dosage of Novo Nordisk’s Wegovy pill assisted patients in achieving an average weight reduction of up to 16.6% over 64 weeks in one late-stage trial. This is comparable to the injectable variant of the drug.

No direct head-to-head studies have been conducted comparing that pill with Eli Lilly’s. In one of Eli Lilly’s late-stage trials, the highest dose of its pill led to a 12.4% average weight loss after 72 weeks.

Despite that difference in effectiveness, Risinger noted that both pills are perceived to promote approximately similar levels of weight reduction. Additionally, some patients may not require the highest doses of either pill, he noted.

In an August memorandum, Goldman analysts predicted that Eli Lilly’s pill will capture a 60% market share — or around $13.6 billion — of the daily oral segment by 2030. They expect Novo Nordisk’s oral semaglutide to command a 21% share — or about $4 billion — of that sector. The analysts indicated that they expect the remaining 19% share to be distributed among other emerging pills.

Emergence of more competitors

Additional drug manufacturers are racing to introduce their own oral options to the marketplace, including Pfizer, AstraZeneca, Structure TherapeuticsViking Therapeutics.

Risinger emphasized Structure’s daily oral GLP-1, which is set to enter phase three trials later this year. Shares of Structure surged over 100% on December 9 following the release of midstage data indicating that its pill, aleniglipron, enabled patients with obesity to lose over 11% of their weight at 36 weeks, when adjusted for placebo.

Further trial data revealed that a higher dosage of the pill could yield greater efficacy – exceeding 15% weight loss – surpassing outcomes seen with the highest dose of Eli Lilly’s orforglipron. Nevertheless, the tolerability data, or how well patients coped with Structure’s treatment, looked to be less favorable compared to Eli Lilly’s pill.

In a statement at the time, Structure CEO Raymond Stevens expressed that the pill could be “potentially best-in-class” for an oral small-molecule GLP-1.

Risinger anticipates that pill, along with another oral GLP-1 from AstraZeneca, may launch as early as late 2028.

He mentioned that potential weekly pills, instead of daily, with “appealing profiles could shift the market favoring orals.”

Risinger pointed to the privately owned Verdiva Bio, which is developing several oral peptide treatments intended for once-a-week administration. The company is conducting a phase two trial on an oral GLP-1.