Americans possess contrasting perspectives on the economy — with part of the variance stemming from income levels, findings indicate.

Affluent consumers were more inclined to report heightened economic confidence assessments when queried about their outlook for the coming year following changes since the presidential election, as per JPMorgan’s Cost of Living Survey.

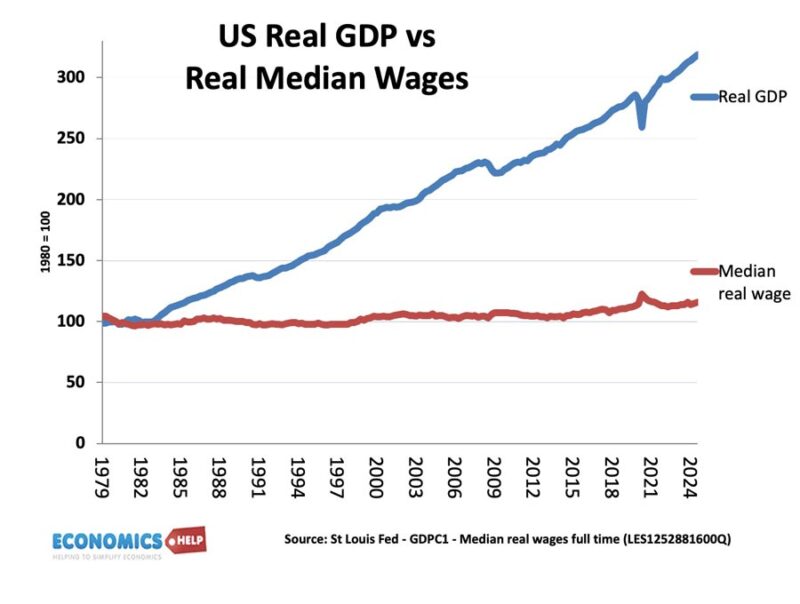

This report adds to the accumulating qualitative and quantitative data illustrating that the U.S. economy is experiencing a “K-shape,” a designation used by economists to depict disparities in economic experiences based on income. In other terms, it elucidates why affluent Americans are continuing to spend while lower-income individuals struggle with inflationary challenges.

“Survey results revealed a significant divide,” wrote JPMorgan’s Matthew Boss, a well-regarded consumer analyst, in a note to clients on Tuesday.

High-income survey participants scored their confidence at an average of 6.2 out of 10 — with 10 as the highest rating. More than half of this group assigned a score between 7 and 10, highlighting their optimistic financial perspective.

Conversely, low-income consumers averaged a score of 4.4. Fewer than 25% of respondents in this group provided a score between 7 and 10, which Boss noted results in a 30-point gap between these demographics.

The overall average confidence rating across income levels was 4.9 out of 10.

This income-based disparity was again evident when participants were inquired about their confidence in managing monthly expenses compared to six to twelve months earlier.

Affluent respondents were also more inclined to indicate they planned to boost spending on nonessential items in the upcoming year compared to other income brackets, according to JPMorgan’s survey.

JPMorgan is not the only entity noticing a contrast among income classes regarding their economic perspectives.

The highest earning one-third have reported an average consumer sentiment score approximately 25% above that of the lowest one-third over the past two years, based on the University of Michigan’s monthly consumer survey.

The latest findings from the Michigan survey reflect discussions held from July 29 to Aug. 25 with a statistically representative sample of around 1,000 American households.