The tariffs implemented by President Donald Trump, designed to bring back American jobs lost to international production, may unintentionally lead to a reduction in the domestic workforce, as suggested by the latest remarks from business leaders and economic analysts.

Amid an already strained labor market in a no-fire, no-hire environment, there are increasing fears that the tariffs on U.S. imports will escalate operational expenses, compelling firms to downsize their employee numbers.

For example, participants in the Institute for Supply Management’s November factory conditions survey expressed heightened concerns.

“We are beginning to implement more permanent adjustments due to the tariff situation,” indicated a transportation equipment industry executive. “This includes staff reductions, new directions for shareholders, and the establishment of additional offshore production that would have otherwise been designated for U.S. exports.”

The ISM surveys anonymize respondents by their industry rather than by name.

Comparable remarks appeared throughout the report, which indicated that the ISM manufacturing index has moved further into a zone that suggests weakening business conditions. The headline figure of 48.2% reflects the portion of businesses reporting growth, making any score below 50% a signal of contraction.

The employment index of the survey dropped 2 points to 44%, marking its lowest level since August and aligning with the ongoing yet steady trend of labor market deterioration.

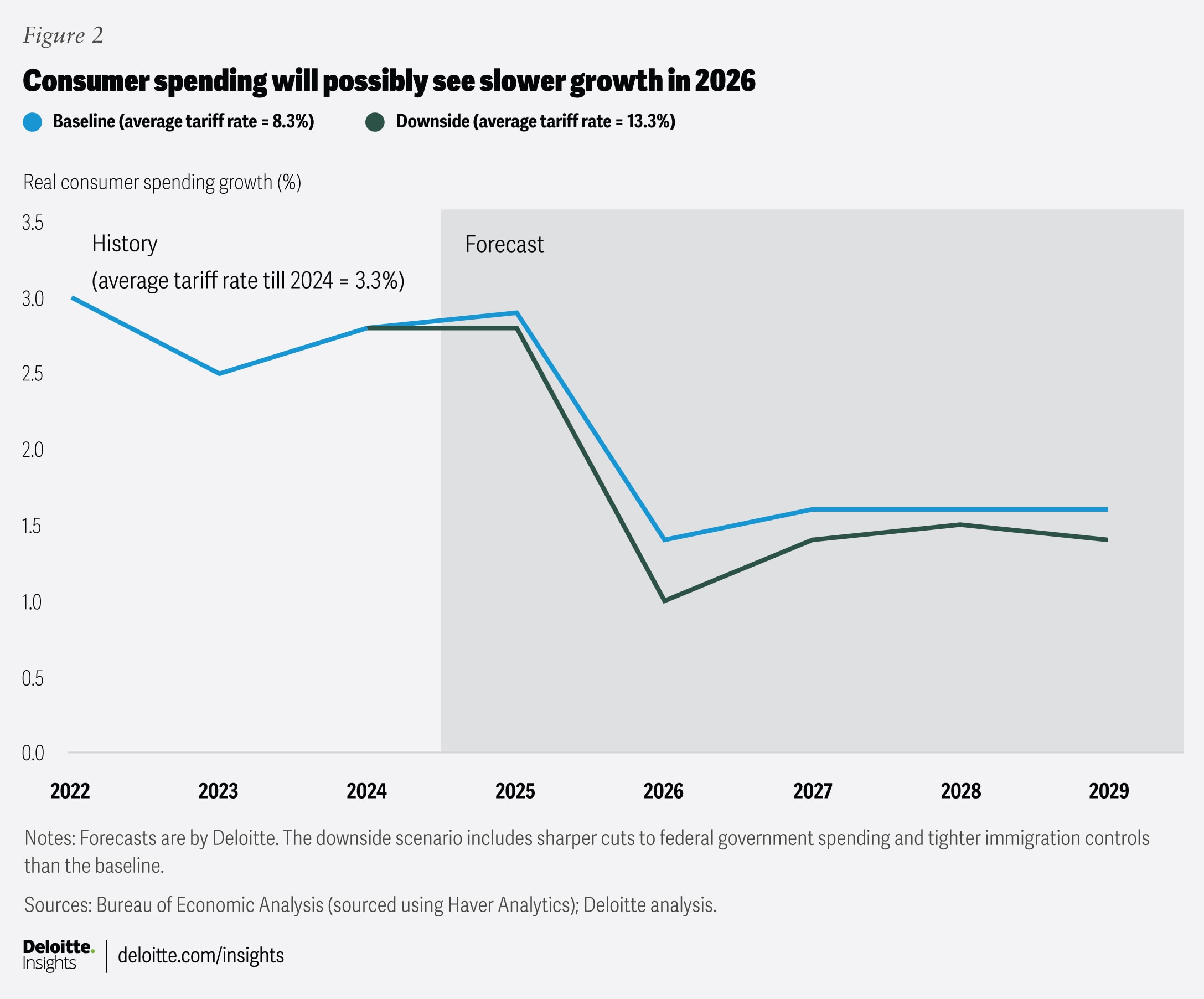

Additional indicators point to a worsening labor outlook as 2026 approaches.

Trump has been a strong advocate for energy exploration and the increased use of fossil fuels. However, an ISM participant from the oil and coal sector noted, “No significant changes are occurring currently, but as we approach 2026, we anticipate substantial shifts in cash flow and workforce size. The organization has divested a significant portion of its operations that generated free cash and has provided voluntary severance packages to all employees.”

A manager in the electrical equipment, appliances, and components sector remarked that tariffs are fostering a tougher business environment than during the Covid pandemic.

“Conditions are more challenging now than during the coronavirus crisis regarding supply chain unpredictability,” the participant stated.

Contradictory signs

Nevertheless, overarching economic conditions seem to remain relatively stable.

The third quarter’s gross domestic product is projected to grow at an annualized rate of 3.9%, according to the Atlanta Federal Reserve. Moreover, hiring in September exceeded expectations, with nonfarm payrolls rising by 119,000, despite indications that major employers are making cuts. For instance, Amazon disclosed in late October that it would be eliminating up to 30,000 positions, joining the ranks of other large companies announcing reductions.

A report released on Tuesday by the 38-nation Organization for Economic Cooperation and Development indicated that tariffs have not yet significantly impacted the global economy but cautioned that the full consequences may still be forthcoming.

“The effects of increased tariff rates have yet to be fully experienced within the U.S. economy,” the OECD report from Paris asserted. The document highlighted a “marked decline in the value of U.S. imported goods subject to tariffs,” suggesting that tariffs are influencing demand and will continue to impact trade volumes as the announced tariffs come into complete effect.”

An economic analysis from the Federal Reserve last week also indicated that employment “declined slightly” over the past seven weeks, while manufacturers noted that “tariffs and tariff uncertainty continued to be obstacles.”

Insights from the Cleveland Fed showcased both facets of the tariff issue: “One large retailer reported an average cost increase of approximately 20 percent year-over-year due to tariffs and was assessing how to manage these increases. Conversely, another sizable retailer did not expect any additional cost hikes, claiming that tariff impacts had stabilized.”